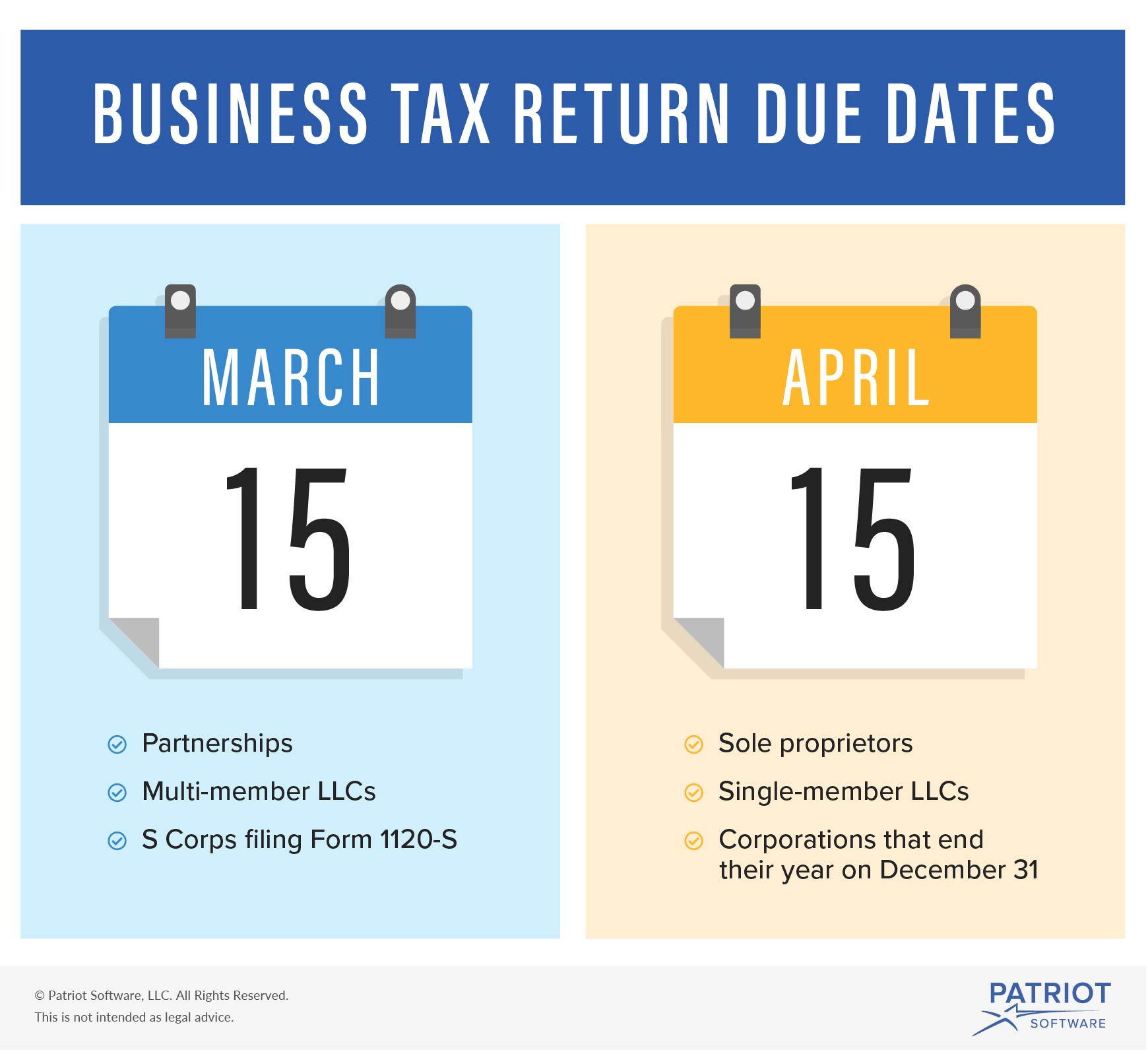

When Are Corporate Taxes Due 2025 Llc. Llcs classified as s corporations must meet the march 15, 2025, tax filing deadline by submitting irs form 1120s and providing each shareholder with a schedule. Here are the 2025 deadlines.

An llc can elect to be taxed as a sole proprietorship, partnership, or corporation. We’ll set you up with a dedicated team of bookkeepers and a.

Small Business Tax Preparation Checklist How to Prepare for Tax Season, The due date for the fourth quarter of 2025 estimated tax payment. March 27, 2025 — 01:41 pm edt.

Corporate tax definition and meaning Market Business News, The filing system can be accessed by visiting. Estimated tax payment for q4 2025 is due on january 15, 2025;

مالیات چیست ؟ تعریف، مفاهیم و انواع — به زبان ساده فرادرس مجله, By now, you’ve probably memorized the fact that tax day. Offer valid through april 23, 2025.

Tax Day 2025 Why aren't taxes due on April 17? Marca, This deadline applies to partnerships, llcs that are taxed as a partnership, and s corp tax returns. Also, most sole proprietorships must submit estimated tax payments quarterly.

When are Corporate Taxes Due? CruseBurke, Here are the 2025 deadlines. It provides supplemental federal income tax information for corporations.

How Should LLCs Handle Corporate Tax on Retained Earnings?, Offer valid through april 23, 2025. By now, you’ve probably memorized the fact that tax day.

Corporate Taxes KDA Inc., Here are the 2025 deadlines. The last day for corporations to file their 2025 tax returns with an extension.

When are Corporate Taxes Due Ultimate Guide AccountingFirms, New reporting requirements for llcs will begin to take effect in 2025 under the corporate transparency act, a federal law aimed at preventing. It’s easy to get these dates confused, but just.

Corporate Taxes Accounting Firm Toronto GTA Accounting Professional, By now, you’ve probably memorized the fact that tax day. For 2025, payment for the first quarter is due april 15, the second quarter on june 17, and the third quarter on september 16.

Corporate Taxes and Union Wages in the United States, In a recently released research document, oxfam stated that major united states. The filing system can be accessed by visiting.

Llcs classified as s corporations must meet the march 15, 2025, tax filing deadline by submitting irs form 1120s and providing each shareholder with a schedule.

The first reporting companies subject to the cta’s reporting requirements—those formed or registered to do business in the united states on january.