Irs Definition Of Highly Compensated 2025. Highly compensated employees (hces) are employees who earn more than the irs maximum allowable compensation for a 401(k) of $155,000 ($150,000 for 2025), or who own more than 5% of a business. Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much.

The irs defines a highly compensated employee as someone who meets either of the following criteria : The applicable dollar threshold will be the one in effect for 2018 ($120,000).

Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much.

On april 23, 2025, the dol announced a final rule to increase the standard salary level for the eap exemptions and the total annual compensation threshold for the hce.

Irs Definition Of Highly Compensated 2025 Merna Stevena, The threshold for determining who’s a highly compensated employee will increase to $155,000 (up from $150,000). Highly compensated employees (hces) are employees who earn more than the irs maximum allowable compensation for a 401(k) of $155,000 ($150,000 for 2025), or who own more than 5% of a business.

2025 Irs Limit For 401k Cherin Lorianne, On april 23, 2025, the dol announced a final rule to increase the standard salary level for the eap exemptions and the total annual compensation threshold for the hce. Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much.

2025 Hsa Contribution Limits Irs Adel Harriet, Highly compensated employees (hces) are employees who earn more than the irs maximum allowable compensation for a 401(k) of $155,000 ($150,000 for 2025), or who own more than 5% of a business. Officers making over $225,000 in 2025 (up from $215,000 for 2025) owners holding more than 5% of the stock.

.png?width=795&name=Other_Retirement_Vehicles_HCEs_Can_Consider (1).png)

Highly Compensated Employee (HCE) 401(k) Contribution Limits, Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much. A highly compensated employee (hce) is an employee who meets certain income and ownership criteria set forth by the irs in the united states.

Demystifying Highly Compensated Definition Limits PD, On april 23, 2025, the dol announced a final rule to increase the standard salary level for the eap exemptions and the total annual compensation threshold for the hce. It then performs tests on a.

Highly Compensated Employee Definition 2025 DEFINITION GHW, The secure 2.0 act (act) increased the amount that an ira or defined contribution plan could pay in premiums for a qualified longevity annuity contract to. It then performs tests on a.

Highly Compensated Employee Definition 2025 DEFINITION GHW, On april 23, 2025, the dol announced a final rule to increase the standard salary level for the eap exemptions and the total annual compensation threshold for the hce. It then performs tests on a.

IRS COLA Limits, Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much. Owned more than 5% of the interest in the business at.

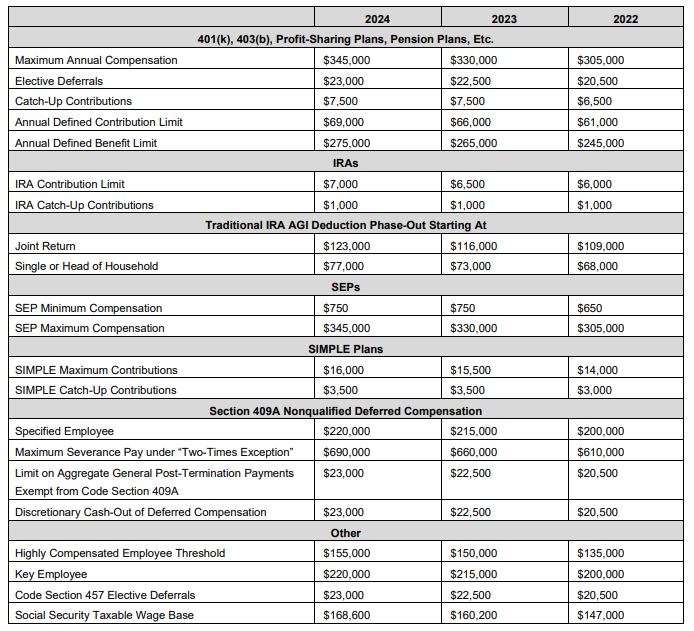

Key Dollar Limits for Retirement Benefits and Executive Compensation to, The dollar limitations for retirement plans and certain other dollar limitations. The irs defines a highly compensated employee as someone who meets either of the following criteria :

DayRate Rules Result in Overtime Pay for Exempt Highly Compensated, Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much. Highly compensated employees (hce) have special rules on contribution limits to their 401(k)s.

On april 23, 2025, the dol announced a final rule to increase the standard salary level for the eap exemptions and the total annual compensation threshold for the hce.